Understanding What Student Loans Are Federal: A Comprehensive Guide to Federal Student Loans

#### What Student Loans Are FederalWhen considering higher education, one of the most significant financial decisions students face is how to fund their edu……

#### What Student Loans Are Federal

When considering higher education, one of the most significant financial decisions students face is how to fund their education. Among the various options available, federal student loans are a popular choice due to their favorable terms and protections. But what exactly are federal student loans?

Federal student loans are loans provided by the government to help students pay for their education. These loans typically offer lower interest rates compared to private loans, and they come with various repayment plans and forgiveness options that can make repayment more manageable. Understanding what student loans are federal is crucial for students and their families as they navigate the complexities of financing education.

#### Types of Federal Student Loans

There are several types of federal student loans, each designed to meet the needs of different students. The primary types include:

1. **Direct Subsidized Loans**: These loans are available to undergraduate students who demonstrate financial need. The government pays the interest while the student is enrolled at least half-time and during deferment periods.

2. **Direct Unsubsidized Loans**: Unlike subsidized loans, these are available to both undergraduate and graduate students, regardless of financial need. Interest accrues while the student is in school, but repayment options are flexible.

3. **Direct PLUS Loans**: These loans are available for graduate students and parents of dependent undergraduate students. They require a credit check, and the interest rates are generally higher than those for subsidized and unsubsidized loans.

4. **Direct Consolidation Loans**: This option allows borrowers to combine multiple federal student loans into a single loan, simplifying repayment by having only one monthly payment.

#### Benefits of Federal Student Loans

Understanding what student loans are federal also involves recognizing their advantages. Federal loans typically offer:

- **Fixed Interest Rates**: Unlike many private loans, federal loans have fixed interest rates, which means the rate will not change over the life of the loan.

- **Flexible Repayment Plans**: Federal student loans offer various repayment plans, including income-driven repayment options that adjust monthly payments based on the borrower’s income.

- **Loan Forgiveness Programs**: Certain federal loans may qualify for forgiveness after a specified number of payments or if the borrower works in qualifying public service jobs.

- **Deferment and Forbearance Options**: If borrowers encounter financial difficulties, federal loans provide options to temporarily postpone payments without negatively impacting their credit score.

#### How to Apply for Federal Student Loans

To access federal student loans, students must complete the Free Application for Federal Student Aid (FAFSA). This form collects financial information to determine eligibility for federal aid, including grants, work-study programs, and loans. It is essential to fill out the FAFSA accurately and submit it on time to maximize financial aid opportunities.

#### Conclusion

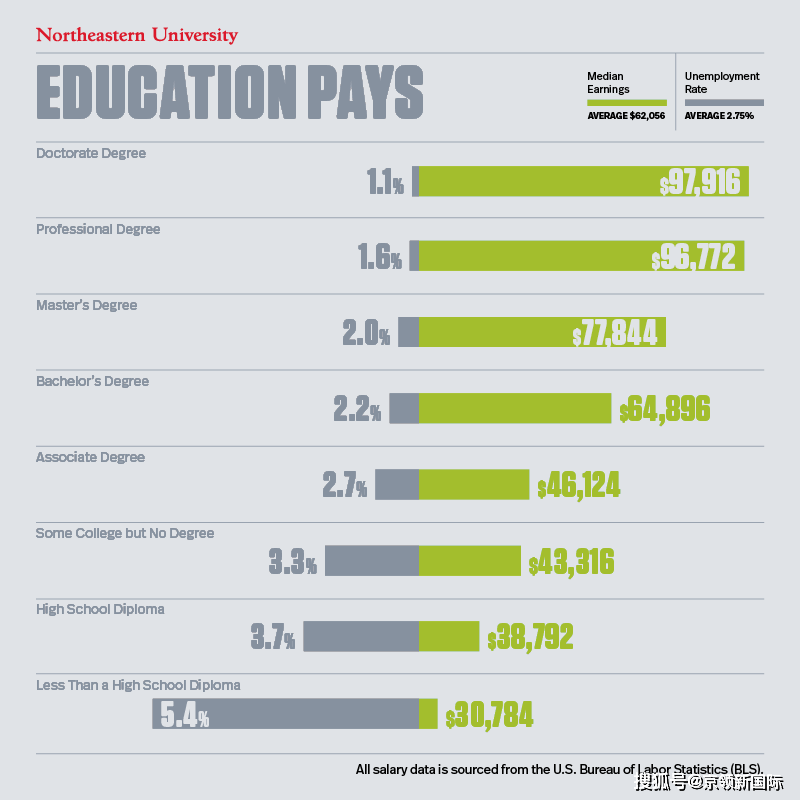

In summary, understanding what student loans are federal is essential for students seeking financial assistance for their education. Federal student loans offer numerous benefits, including lower interest rates, flexible repayment options, and potential loan forgiveness. By exploring these options and completing the FAFSA, students can make informed decisions about funding their education and achieving their academic goals. As you consider your financial future, take the time to research and understand the federal student loan options available to you.