Understanding the Benefits of a Mortgage Loan for Second Home Purchases

#### Mortgage Loan for Second HomeWhen considering the purchase of a second home, many potential buyers often contemplate the financial implications and the……

#### Mortgage Loan for Second Home

When considering the purchase of a second home, many potential buyers often contemplate the financial implications and the best financing options available. One of the most popular choices is a mortgage loan for second home. This type of loan allows buyers to secure financing for a property that is not their primary residence, enabling them to invest in vacation homes, rental properties, or even a place for family gatherings.

#### What is a Mortgage Loan for Second Home?

A mortgage loan for second home is specifically designed for individuals looking to buy an additional property. Unlike primary residence loans, lenders may have different criteria for second home mortgages, often requiring a larger down payment and higher credit scores. This is because second homes are considered a greater risk for lenders; if financial difficulties arise, borrowers are more likely to prioritize their primary residence over a secondary one.

#### Benefits of a Mortgage Loan for Second Home

There are several advantages to obtaining a mortgage loan for second home:

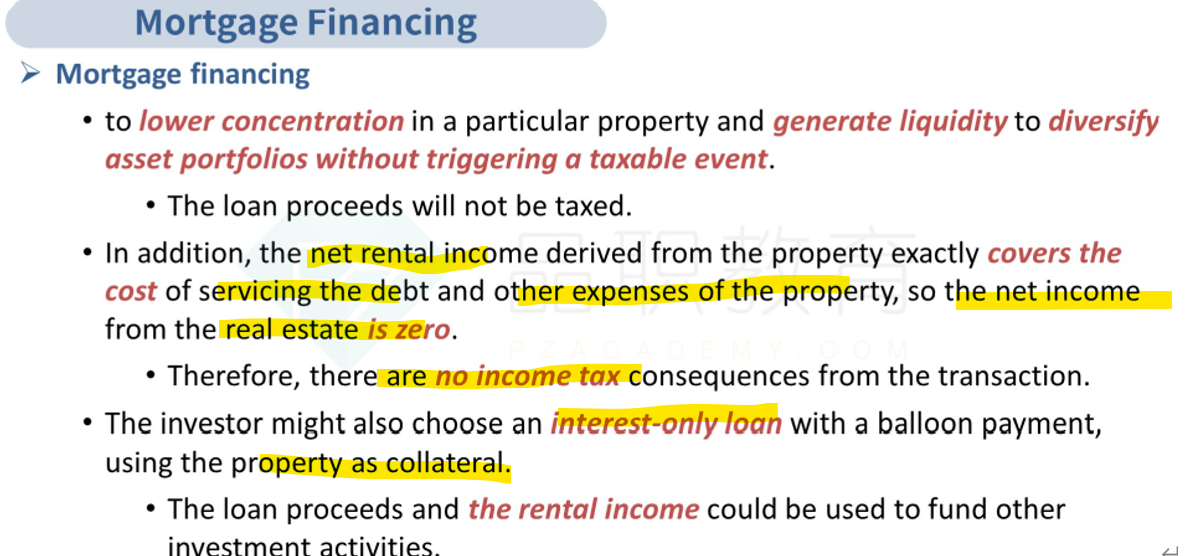

1. **Investment Opportunity**: Purchasing a second home can be a lucrative investment. If you choose to rent out the property, it can generate additional income that may cover mortgage payments and other expenses.

2. **Tax Deductions**: In many cases, mortgage interest on a second home may be tax-deductible, similar to your primary residence. This can provide significant savings during tax season.

3. **Personal Use**: A second home can serve as a personal retreat, providing a space for vacations and family gatherings. This can enhance your quality of life and provide a sense of stability for family traditions.

4. **Potential Appreciation**: Real estate often appreciates over time. Owning a second home can be a way to build wealth, as the property may increase in value over the years.

5. **Diversification**: A second home can be a part of a broader investment strategy, diversifying your assets and potentially providing a hedge against market fluctuations.

#### Considerations When Applying for a Mortgage Loan for Second Home

While there are many benefits to a mortgage loan for second home, there are also important considerations to keep in mind:

- **Higher Down Payments**: Lenders typically require a larger down payment for second homes, often around 20% or more. This is to mitigate the risk associated with non-primary residences.

- **Creditworthiness**: A strong credit score is essential for securing favorable loan terms. Lenders may scrutinize your financial history more closely when you apply for a second home mortgage.

- **Debt-to-Income Ratio**: Lenders will evaluate your debt-to-income ratio to ensure that you can manage the additional mortgage payments alongside your existing obligations.

- **Location and Market Trends**: The location of your second home can significantly impact its value and rental potential. Researching market trends in the area is crucial for making an informed decision.

- **Property Management**: If you plan to rent out your second home, consider the logistics of property management. This includes maintenance, tenant management, and local regulations regarding rentals.

#### Conclusion

A mortgage loan for second home can open up a world of possibilities for those looking to invest in real estate or create lasting family memories. By understanding the benefits and considerations associated with this type of loan, potential buyers can make informed decisions that align with their financial goals. Whether you're seeking a cozy retreat or a profitable investment, a second home can be a valuable addition to your portfolio.