Discover the Latest Updates on Your wells fargo status of loan application: A Comprehensive Guide to Tracking Your Loan Progress

When it comes to securing a loan, understanding the wells fargo status of loan application is crucial for applicants. Whether you are applying for a mortgag……

When it comes to securing a loan, understanding the wells fargo status of loan application is crucial for applicants. Whether you are applying for a mortgage, personal loan, or auto loan, knowing where you stand in the application process can alleviate anxiety and help you plan your financial future. In this article, we will explore how to check the status of your Wells Fargo loan application, what to expect during the approval process, and tips for improving your chances of approval.

First and foremost, tracking the wells fargo status of loan application can be done easily through several methods. Wells Fargo offers an online banking platform that allows you to log in and view your loan application status in real-time. If you don’t have online banking set up, you can also call their customer service line for assistance. Be sure to have your application details handy to expedite the process.

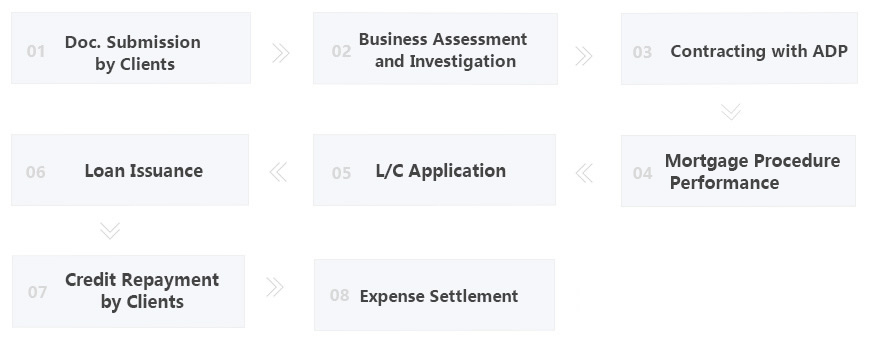

Once you have accessed your wells fargo status of loan application, you may encounter various stages, such as "Application Received," "Under Review," or "Approved." Each stage has its own timeframe, so it’s important to be patient. Typically, the review process can take anywhere from a few days to several weeks, depending on the type of loan and the completeness of your application.

If your application is under review, this means that Wells Fargo is assessing your credit history, income, and other financial factors to determine your eligibility. During this time, it’s advisable to avoid making any major financial changes, such as taking on new debt or changing jobs, as these can impact your approval chances.

In the event that your wells fargo status of loan application shows that your application has been denied, don’t be discouraged. Wells Fargo will provide you with a reason for the denial, and there are often steps you can take to improve your financial situation and reapply in the future. For instance, you might consider paying down existing debt, improving your credit score, or providing additional documentation to support your financial stability.

Additionally, it’s worth noting that Wells Fargo offers various resources to help applicants understand the loan process better. Their website features articles and tools that can guide you through the application process and help you prepare for what comes next. Utilizing these resources can significantly enhance your understanding of the wells fargo status of loan application and increase your chances of a successful outcome.

In conclusion, keeping tabs on your wells fargo status of loan application is a vital part of the loan process. By utilizing Wells Fargo’s online tools, understanding the stages of your application, and knowing what to do in case of a denial, you can navigate the loan application process with confidence. Remember, being proactive and informed can make a significant difference in your borrowing experience. So take the time to stay updated and make the most of the resources available to you.