Unlock Your Business Potential: How to Apply for PPP Loan and Secure Financial Relief

Guide or Summary:Introduction to PPP LoansWhy You Should Apply for PPP LoanEligibility Criteria for PPP LoansSteps to Apply for PPP LoanTips for a Successfu……

Guide or Summary:

- Introduction to PPP Loans

- Why You Should Apply for PPP Loan

- Eligibility Criteria for PPP Loans

- Steps to Apply for PPP Loan

- Tips for a Successful PPP Loan Application

Introduction to PPP Loans

The Paycheck Protection Program (PPP) was designed to provide financial assistance to small businesses affected by the COVID-19 pandemic. If you're a business owner looking for ways to sustain your operations during these challenging times, understanding how to apply for PPP loan can be your gateway to financial relief. This program offers forgivable loans that can help cover payroll costs, rent, utilities, and other essential expenses.

Why You Should Apply for PPP Loan

Applying for a PPP loan can be a game-changer for your business. First and foremost, it offers a lifeline to help you retain employees and keep your business afloat. With the right funding, you can navigate through financial uncertainties and emerge stronger. Additionally, the PPP loan is partially forgivable, meaning that if you use the funds for eligible expenses, you may not have to repay a significant portion of it. This unique feature makes it an attractive option for small business owners.

Eligibility Criteria for PPP Loans

Before you apply for PPP loan, it’s essential to understand the eligibility criteria. Generally, small businesses with fewer than 500 employees, including sole proprietors, independent contractors, and self-employed individuals, can apply. Additionally, your business must have been operational before February 15, 2020, and must have been affected by the pandemic in some capacity. Understanding these criteria will help you determine if you're eligible and how much funding you can potentially receive.

Steps to Apply for PPP Loan

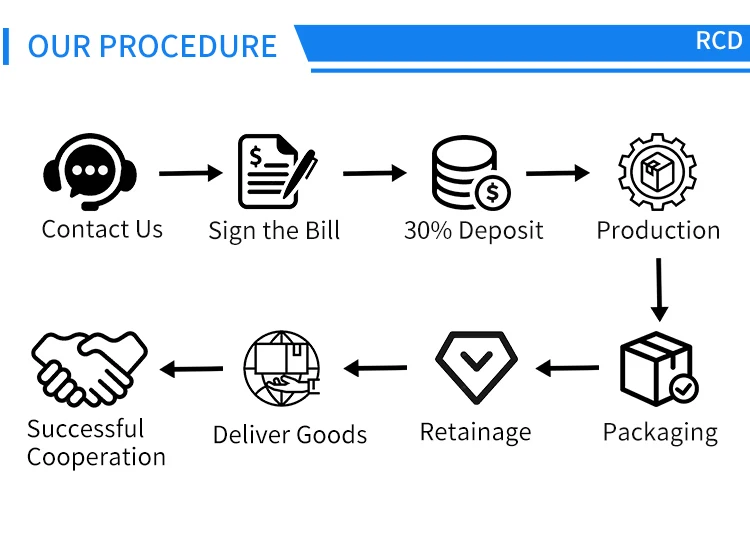

The application process for a PPP loan might seem daunting, but breaking it down into manageable steps can simplify the experience. Here’s how to apply for PPP loan effectively:

1. **Gather Required Documentation**: Before you start the application, collect essential documents such as payroll records, tax filings, and any other financial statements that demonstrate your business’s operational status.

2. **Choose a Lender**: Not all lenders offer PPP loans, so it’s crucial to find one that does. You can apply through banks, credit unions, or online lenders. Check their terms and conditions, as they may vary.

3. **Complete the Application**: Fill out the PPP loan application form accurately. Ensure that all the information provided is correct and that you have included all necessary documentation.

4. **Submit Your Application**: Once your application is complete, submit it to your chosen lender. Be prepared for follow-up questions or requests for additional information.

5. **Await Approval**: After submission, the lender will review your application. If approved, you will receive the loan amount, which you can then use for eligible expenses.

Tips for a Successful PPP Loan Application

To increase your chances of approval, consider the following tips when you apply for PPP loan:

- **Be Thorough**: Ensure that all documentation is complete and accurate. Any discrepancies can lead to delays or denial.

- **Stay Informed**: Keep up with any changes in the PPP guidelines, as they can evolve. Being informed will help you navigate the application process more effectively.

- **Consult Professionals**: If you're unsure about any part of the process, consider consulting with a financial advisor or accountant who has experience with PPP loans.

In conclusion, applying for a PPP loan can provide your business with the financial support it needs to weather the storm of economic uncertainty. By understanding the eligibility criteria, following the application steps, and applying with thoroughness, you can unlock the potential of this program. Don’t hesitate to take action—apply for PPP loan today and secure the future of your business. Remember, the sooner you apply, the sooner you can access the funds necessary to sustain your operations and support your employees.