Understanding and Calculating RV Loans with Finance Calculator Tools

Guide or Summary:RV LoanFinance CalculatorRV Loan: A Detailed OverviewUsing Finance Calculator Tools for RV LoansBenefits of Using Finance Calculator Tools……

Guide or Summary:

- RV Loan

- Finance Calculator

- RV Loan: A Detailed Overview

- Using Finance Calculator Tools for RV Loans

- Benefits of Using Finance Calculator Tools for RV Loans

RV Loan

When it comes to purchasing a recreational vehicle (RV), the financing aspect can be quite complex and daunting. With the rising popularity of RVs as a second home or a means of adventure, many individuals are opting to finance their purchase. However, the process of obtaining an RV loan can be intricate, involving various terms, interest rates, and repayment options. This is where finance calculator tools come into play, offering a comprehensive approach to understanding and calculating RV loans.

Finance Calculator

Finance calculators are essential tools for anyone looking to finance an RV. These calculators provide a streamlined way to input various financial parameters, such as the loan amount, interest rates, and repayment periods, and generate accurate projections of monthly payments, total interest paid, and the overall cost of the loan. By using finance calculator tools, potential RV buyers can make informed decisions based on realistic financial scenarios.

RV Loan: A Detailed Overview

An RV loan is a type of financing specifically designed for the purchase of recreational vehicles. These loans can be secured or unsecured, depending on the lender's requirements. Secured loans typically require collateral, such as the RV itself, while unsecured loans do not. The interest rates for RV loans can vary widely, depending on the lender, the borrower's credit score, and the loan term.

Using Finance Calculator Tools for RV Loans

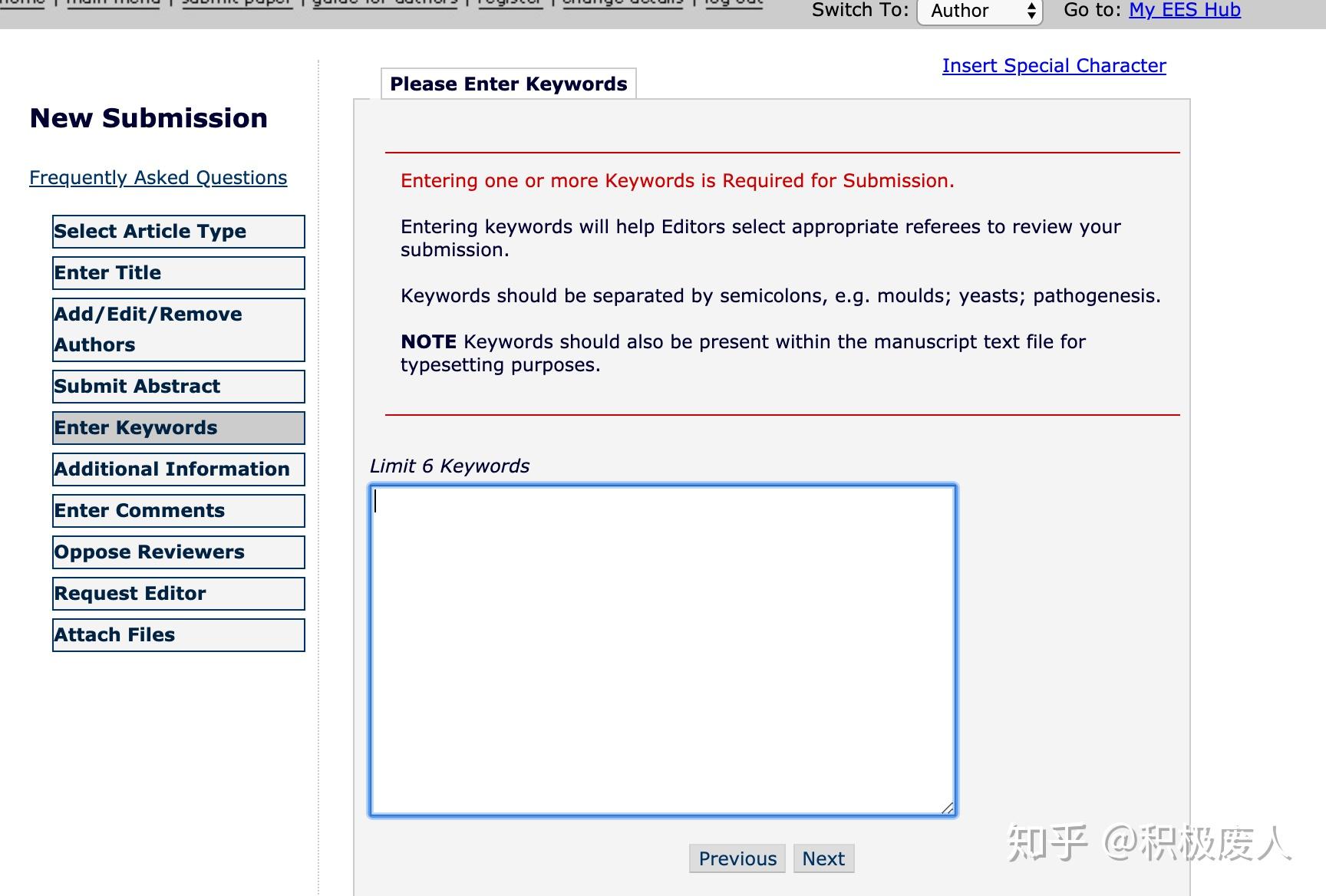

When using finance calculator tools for RV loans, it is essential to input accurate and up-to-date information. This includes the loan amount, interest rate, and repayment term. By doing so, users can obtain reliable and precise calculations that reflect their specific financial situation.

For instance, let's consider a potential RV buyer who wants to purchase a $50,000 RV with a 10-year loan term and an interest rate of 6%. By inputting these figures into a finance calculator, the user can determine the monthly payment, which would be approximately $459. Additionally, the calculator would provide an estimate of the total interest paid over the course of the loan, amounting to around $4,800. This information is crucial for making an informed decision, as it allows the buyer to assess the long-term financial implications of the loan.

Benefits of Using Finance Calculator Tools for RV Loans

There are several benefits to using finance calculator tools for RV loans. Firstly, they provide a quick and easy way to compare different loan options. By inputting various loan terms and interest rates, users can evaluate which option offers the best value for money. Secondly, these tools help to demystify the complexities of RV financing, making it easier for individuals to navigate the process. Finally, finance calculator tools offer a level of transparency and accuracy in loan calculations, ensuring that potential buyers can make well-informed financial decisions.

In conclusion, finance calculator tools are indispensable for anyone looking to finance an RV. By providing accurate and comprehensive loan calculations, these tools enable potential buyers to make informed decisions based on realistic financial scenarios. Whether you are purchasing an RV for adventure, a second home, or any other purpose, using a finance calculator can help you navigate the complexities of RV financing with confidence and ease.