How to Effectively Calculate Mortgage Loan Amount for Your Dream Home

#### Understanding Mortgage LoansA mortgage loan is a type of loan specifically used to purchase real estate. When buying a home, most people do not have en……

#### Understanding Mortgage Loans

A mortgage loan is a type of loan specifically used to purchase real estate. When buying a home, most people do not have enough cash to pay for the property outright. That's where mortgage loans come in. They allow you to borrow money from a lender, such as a bank or credit union, and pay it back over time, typically with interest. Understanding how to calculate mortgage loan amount is crucial for potential homeowners to ensure they can afford their dream home without overextending their finances.

#### Factors Influencing Mortgage Loan Amount

When you calculate mortgage loan amount, several factors come into play. These include:

1. **Home Purchase Price**: The total cost of the home you wish to buy is the starting point for your mortgage calculation.

2. **Down Payment**: This is the initial amount you pay upfront. The larger your down payment, the less you need to borrow.

3. **Interest Rate**: The interest rate can significantly affect your monthly payments and the total amount you’ll pay over the life of the loan.

4. **Loan Term**: This refers to the length of time you have to repay the loan. Common terms are 15, 20, or 30 years.

5. **Credit Score**: Your credit score can influence the interest rate you receive, which in turn affects your mortgage loan amount.

#### Calculating Your Mortgage Loan Amount

To accurately calculate mortgage loan amount, follow these steps:

1. **Determine Your Budget**: Assess your finances to understand how much you can afford to spend on a home. This includes considering your income, expenses, and any existing debts.

2. **Calculate the Down Payment**: Typically, down payments range from 3% to 20% of the home’s purchase price. For example, if you’re buying a $300,000 home and plan to put down 20%, your down payment would be $60,000.

3. **Subtract the Down Payment from the Home Price**: This will give you the amount you need to borrow. Using the previous example, $300,000 (home price) - $60,000 (down payment) = $240,000 (mortgage loan amount).

4. **Consider Additional Costs**: Don't forget to factor in closing costs, property taxes, and homeowners insurance, which may also affect your overall budget and loan amount.

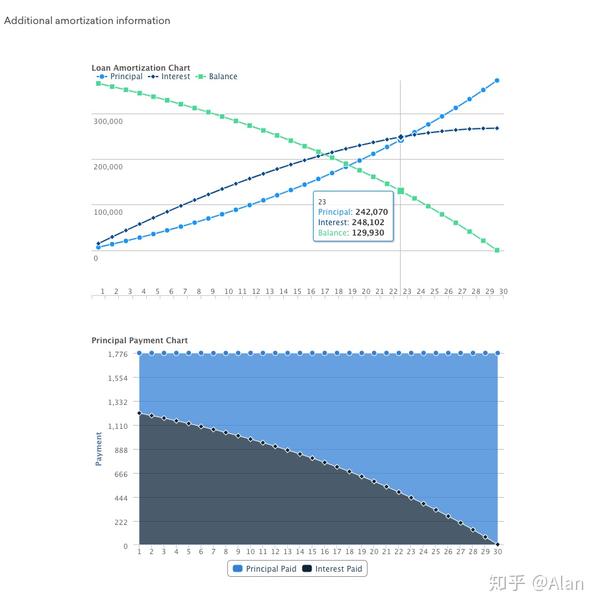

#### Using Online Calculators

Many online tools can help you calculate mortgage loan amount quickly and easily. These calculators allow you to input various factors such as home price, down payment, interest rate, and loan term to provide you with an estimated monthly payment and total loan amount. This can be an invaluable resource for first-time homebuyers or anyone looking to refinance.

#### Conclusion

Calculating your mortgage loan amount is a critical step in the home-buying process. By understanding the components that influence your loan and using available resources, you can make informed decisions that align with your financial goals. Remember, the key to successful homeownership is not just securing a mortgage but ensuring that you can comfortably manage the payments over time. With careful planning and consideration, you can achieve your dream of homeownership while maintaining financial stability.