"Mastering Your Financial Future: A Comprehensive Guide to Loan Repayment Loan Strategies"

Guide or Summary:Understanding Loan Repayment LoanThe Importance of Loan Repayment LoanStrategies for Effective Loan Repayment LoanCommon Challenges in Loan……

Guide or Summary:

- Understanding Loan Repayment Loan

- The Importance of Loan Repayment Loan

- Strategies for Effective Loan Repayment Loan

- Common Challenges in Loan Repayment Loan

- The Role of Financial Education in Loan Repayment Loan

#### Translation: Loan Repayment Loan

---

Understanding Loan Repayment Loan

Loan repayment loan refers to the structured process of paying back borrowed funds, typically through a series of scheduled payments over a specified period. This concept encompasses various types of loans, including personal loans, student loans, and mortgages. Understanding the nuances of loan repayment is crucial for anyone who has taken out a loan, as it directly impacts your financial health and credit score.

The Importance of Loan Repayment Loan

Loan repayment is not just a financial obligation; it is a critical component of personal finance management. Timely repayments can enhance your credit score, making it easier to secure future loans at favorable interest rates. Conversely, missed payments can lead to penalties, increased interest rates, and a damaged credit history. Therefore, understanding the terms of your loan repayment loan is essential for maintaining financial stability.

Strategies for Effective Loan Repayment Loan

1. **Create a Budget**: Start by assessing your monthly income and expenses. Allocate a specific portion of your budget to loan repayments. This will ensure that you prioritize your obligations and avoid late payments.

2. **Choose the Right Repayment Plan**: Many loans offer different repayment plans, such as fixed or variable rates. Evaluate which plan suits your financial situation best. For example, a fixed-rate plan may offer stability, while a variable rate could potentially lower your payments in the long run.

3. **Make Extra Payments**: If your financial situation allows, consider making extra payments towards your loan. This can significantly reduce the principal amount and, consequently, the total interest paid over the life of the loan.

4. **Consolidate Loans**: If you have multiple loans, consolidating them into a single loan can simplify your repayment process. This often results in a lower interest rate and a single monthly payment, making it easier to manage your finances.

5. **Utilize Automatic Payments**: Setting up automatic payments can help ensure you never miss a due date. Many lenders offer discounts for enrolling in automatic payment plans, which can save you money in the long run.

Common Challenges in Loan Repayment Loan

Despite the best intentions, borrowers often face challenges in loan repayment. Unexpected expenses, job loss, or changes in financial circumstances can hinder your ability to make timely payments. In such cases, communication with your lender is key. Many lenders offer deferment or forbearance options for borrowers facing financial hardships. It’s essential to reach out and discuss your situation before it escalates into a more significant issue.

The Role of Financial Education in Loan Repayment Loan

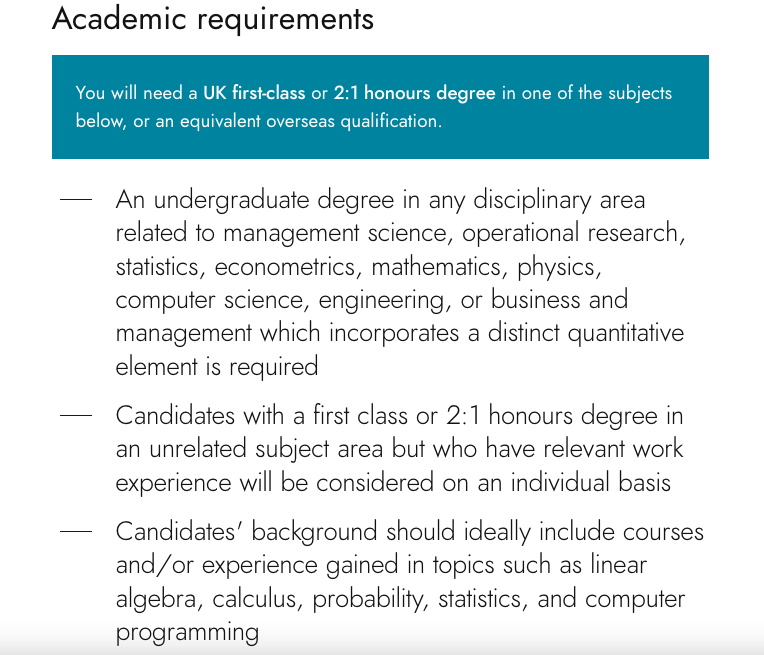

Financial literacy plays a vital role in successful loan repayment. Understanding interest rates, loan terms, and repayment options empowers borrowers to make informed decisions. Various resources, including financial advisors, online courses, and community workshops, can provide valuable insights into managing loans effectively.

Navigating the complexities of loan repayment loan can be daunting, but with the right strategies and knowledge, it is entirely manageable. By prioritizing your financial education, creating a structured repayment plan, and maintaining open communication with your lender, you can master your loan repayment journey. Remember, the goal is not only to repay your loans but to build a solid financial future for yourself.