Understanding the Student Loan Consolidation Deadline: What You Need to Know

The student loan consolidation deadline is a critical date that borrowers must be aware of to effectively manage their student loans. Consolidation offers a……

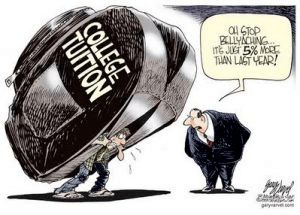

The student loan consolidation deadline is a critical date that borrowers must be aware of to effectively manage their student loans. Consolidation offers a pathway to simplify repayment and potentially lower monthly payments, but missing the deadline can have significant implications for your financial future.

Student loan consolidation allows borrowers to combine multiple federal student loans into a single loan, which can streamline the repayment process. This can be particularly beneficial for those who are juggling multiple loans with varying interest rates and payment schedules. By consolidating, borrowers can lock in a fixed interest rate based on the weighted average of their existing loans, making it easier to budget and plan for future payments.

However, the student loan consolidation deadline varies depending on different factors, including the type of loans you have and the specific programs available. It is essential to stay informed about these deadlines to ensure that you do not miss out on the opportunity to consolidate your loans. For federal student loans, the deadlines can change based on legislative updates and policy changes, so it is vital to check the official Federal Student Aid website or consult with your loan servicer for the most current information.

One of the most significant advantages of student loan consolidation is the potential for lower monthly payments. By extending the repayment term, borrowers can reduce their monthly financial burden, making it more manageable to meet other financial obligations. However, it is important to note that while this may provide immediate relief, it could also result in paying more interest over the life of the loan. Therefore, it is crucial to weigh the pros and cons before proceeding with consolidation.

Additionally, borrowers should be aware that consolidating federal loans into a private loan may result in the loss of certain benefits, such as income-driven repayment plans and loan forgiveness programs. Understanding the long-term implications of consolidation is essential, as it can affect your overall financial health and future opportunities.

To avoid missing the student loan consolidation deadline, it is advisable to create a timeline for your consolidation process. Start by gathering all relevant loan information, including balances, interest rates, and repayment terms. Next, research your options for consolidation, including federal and private loan programs. Finally, make a plan to submit your application well ahead of the deadline to ensure that you have ample time to address any issues that may arise.

In conclusion, the student loan consolidation deadline is a crucial aspect of managing your student loans effectively. By understanding the benefits and limitations of consolidation, staying informed about deadlines, and planning accordingly, you can take control of your student loan repayment strategy. Remember, timely action can lead to significant financial benefits and a more manageable repayment experience.